In today’s unpredictable economic climate, having a financial safety net isn’t just good advice—it’s essential. An emergency fund serves as your first line of defense against life’s unexpected expenses, from sudden car repairs to medical emergencies or job loss.

Yet despite widespread knowledge about the importance of emergency savings, a shocking 59% of Americans in 2025 don’t have enough savings to cover an unexpected $1,000 expense, according to Bankrate’s Annual Emergency Savings Report. CBS News

This comprehensive guide will walk you through everything you need to know about emergency funds: what they are, why you need one, how much to save, where to keep your money, and most importantly—how to build one quickly, even if you’re starting from zero.

We’ll also provide you with our easy-to-use emergency fund calculator to help you determine your ideal savings target based on your personal circumstances.

In this Article:

What Is an Emergency Fund?

An emergency fund is a dedicated pool of money specifically set aside to cover unexpected financial surprises. Unlike your regular savings, which might be earmarked for planned expenses like vacations or a down payment on a house, your emergency fund serves one purpose: to protect you when life throws its inevitable curveballs.

Think of it as a financial buffer that prevents you from going into debt when unexpected expenses arise. Having this cash cushion means you don’t have to rely on high-interest credit cards, personal loans, or—even worse—predatory payday loans when emergencies strike.

Common Types of Emergencies

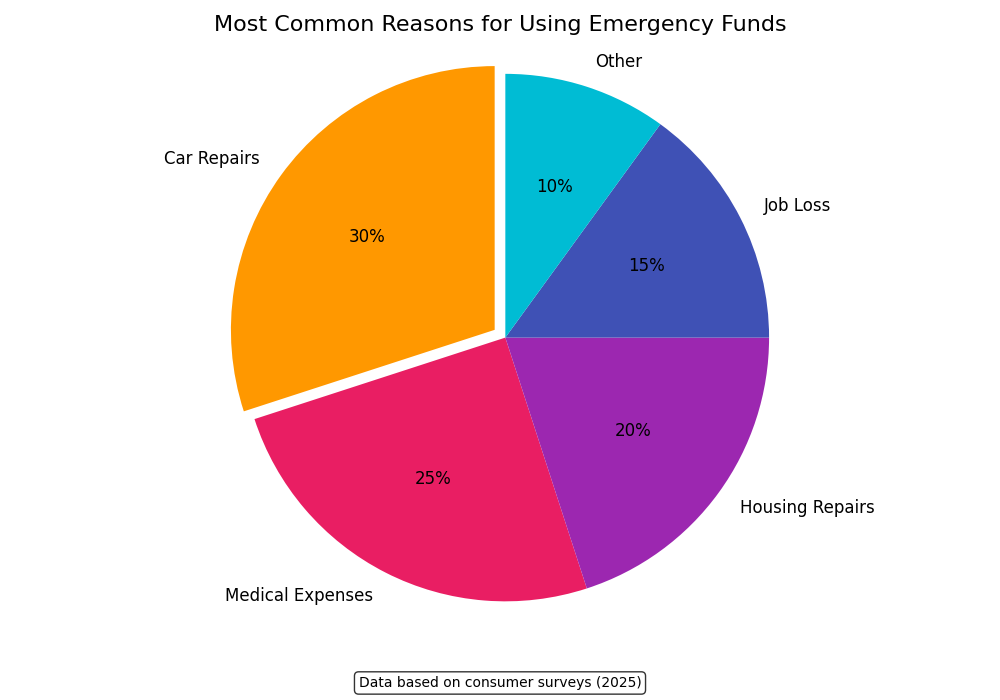

What exactly constitutes a financial emergency? While everyone’s situation is unique, the most common emergency expenses typically fall into these categories:

As you can see, car repairs top the list at 30% of emergency expenses, followed by medical costs (25%), home repairs (20%), and unexpected income disruptions (15%). This data underscores why having an accessible emergency fund is crucial—these situations can happen to anyone at any time.

Why You Need an Emergency Fund in 2025

The financial landscape in 2025 comes with both new opportunities and challenges. Rising interest rates have made savings more rewarding, but economic uncertainty, inflation concerns, and an evolving job market create financial vulnerability for many households.

Here are the key reasons why having an emergency fund is more important than ever:

1. Protection Against Job Loss or Income Reduction

According to recent data, more than 2 in 3 Americans worry they wouldn’t be able to cover their living expenses if they lost their job. FOX56 An emergency fund provides crucial breathing room during periods of unemployment or reduced income.

2. Buffer Against High-Interest Debt

When emergencies hit and you don’t have savings, credit cards often become the default option. With average credit card interest rates near 20% in 2025, even a small emergency can balloon into a significant debt burden over time.

3. Peace of Mind

Financial stress affects both mental and physical health. Knowing you have funds available to handle unexpected expenses provides invaluable peace of mind and reduces anxiety about what the future might bring.

4. Greater Financial Freedom

With an emergency fund in place, you gain the freedom to make better financial and career decisions. This might mean the ability to leave a toxic workplace, pursue entrepreneurial opportunities, or take time for additional education without financial desperation driving your choices.

5. Ability to Handle Multiple Financial Shocks

Research shows that financial emergencies rarely come one at a time. A study by the Federal Reserve found that households facing one financial emergency are more likely to face additional ones within the same year. An emergency fund helps you weather these compounding challenges.

The State of Emergency Savings in America

Before we dive into how much you should save, let’s look at where Americans stand with emergency savings in 2025:

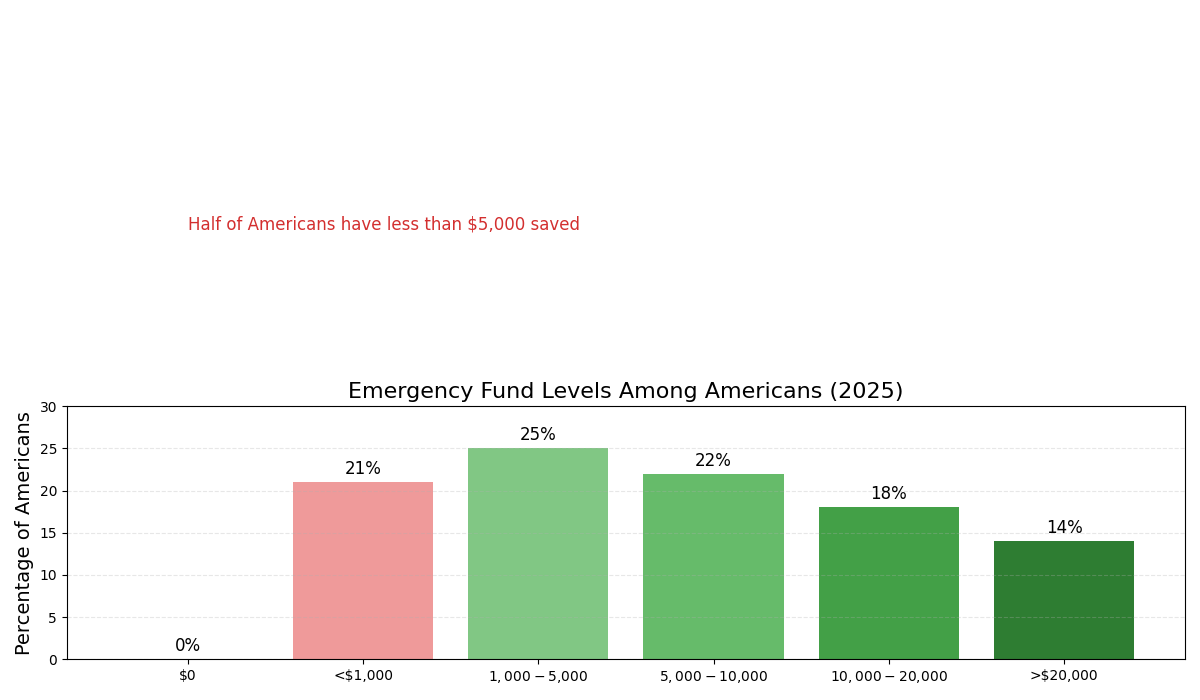

The statistics reveal a concerning reality:

- 21% of Americans have no emergency savings at all

- Another 25% have less than $1,000 saved

- Only 14% have more than $20,000 set aside for emergencies

According to Bankrate’s 2025 Annual Emergency Savings Report, only 28% of Americans have at least six months’ expenses saved, down from 30% in 2023. Bankrate

This savings shortfall leaves the majority of households financially vulnerable to unexpected expenses, highlighting the urgent need to strengthen personal emergency funds.

How Much Should You Save in Your Emergency Fund?

The ideal size of your emergency fund isn’t one-size-fits-all. While conventional wisdom suggests saving 3-6 months of expenses, your specific target should depend on your individual circumstances.

Emergency Fund Tiers

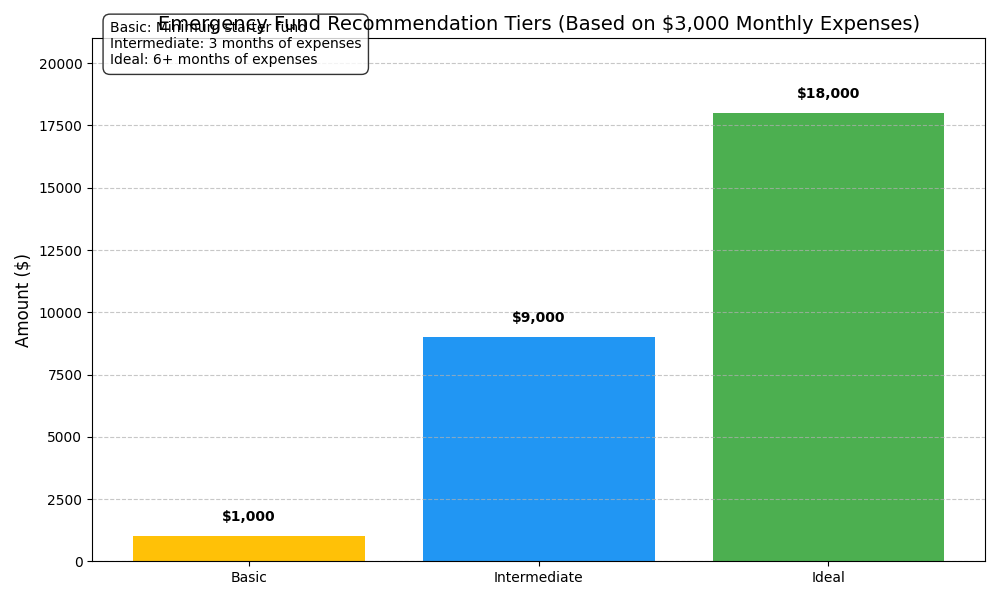

Most financial experts recommend building your emergency fund in stages:

- Starter Emergency Fund ($1,000): This should be your first financial goal before tackling other objectives like paying off debt. It provides a minimal buffer against small emergencies.

- Intermediate Emergency Fund (3 months of expenses): Once you’ve paid off high-interest debt, aim to save enough to cover three months of essential expenses.

- Full Emergency Fund (6+ months of expenses): The ideal safety net for most households, this level of savings can support you through significant financial disruptions like job loss or major medical issues.

Factors That Affect Your Emergency Fund Size

Consider these variables when determining your target amount:

- Income Stability: Those with irregular income (freelancers, seasonal workers, commission-based employees) generally need larger emergency funds than those with stable, predictable incomes.

- Number of Income Earners: Single-income households typically require more robust emergency savings than dual-income households, where the risk of total income loss is reduced.

- Health Status: If you or your dependents have ongoing medical conditions, you may need additional emergency savings to cover potential medical expenses.

- Job Market in Your Field: Consider how long it might take to find new employment in your industry. Highly specialized fields might require longer job searches, necessitating larger emergency funds.

- Fixed Financial Obligations: The more fixed expenses you have (mortgage, car payments, etc.), the more you’ll need in emergency savings.

- Dependents: Supporting children or other family members increases your financial responsibilities and the size of emergency fund you’ll need.

Emergency Fund Calculator: Find Your Personal Target

To determine exactly how much you should save for your emergency fund, use this calculator approach:

Step 1: Calculate Your Monthly Essential Expenses

Add up all necessary monthly expenses, including:

- Housing (rent/mortgage)

- Utilities

- Food

- Transportation

- Insurance premiums

- Minimum debt payments

- Essential personal and family expenses

Step 2: Apply the Multiplier Based on Your Situation

For a basic emergency fund:

- Minimal emergency fund: 1 month of expenses

- Stable dual-income household with high job security: 3 months of expenses

- Single-income household or moderate job security: 6 months of expenses

- Variable income, self-employed, or specialized career: 9-12 months of expenses

Step 3: Adjust for Special Circumstances

Consider adding extra funds if you:

- Have dependents with special needs

- Live in an area prone to natural disasters

- Own an older home or vehicle likely to need repairs

- Have high-deductible insurance plans

- Work in an industry with cyclical layoffs

By using this calculator approach, you’ll arrive at a personalized emergency fund target that reflects your unique financial situation rather than a generic one-size-fits-all recommendation.

Where to Keep Your Emergency Fund

Where you store your emergency fund is almost as important as how much you save. The ideal emergency fund location balances three key factors: liquidity (easy access), safety (no risk of loss), and yield (earning some return).

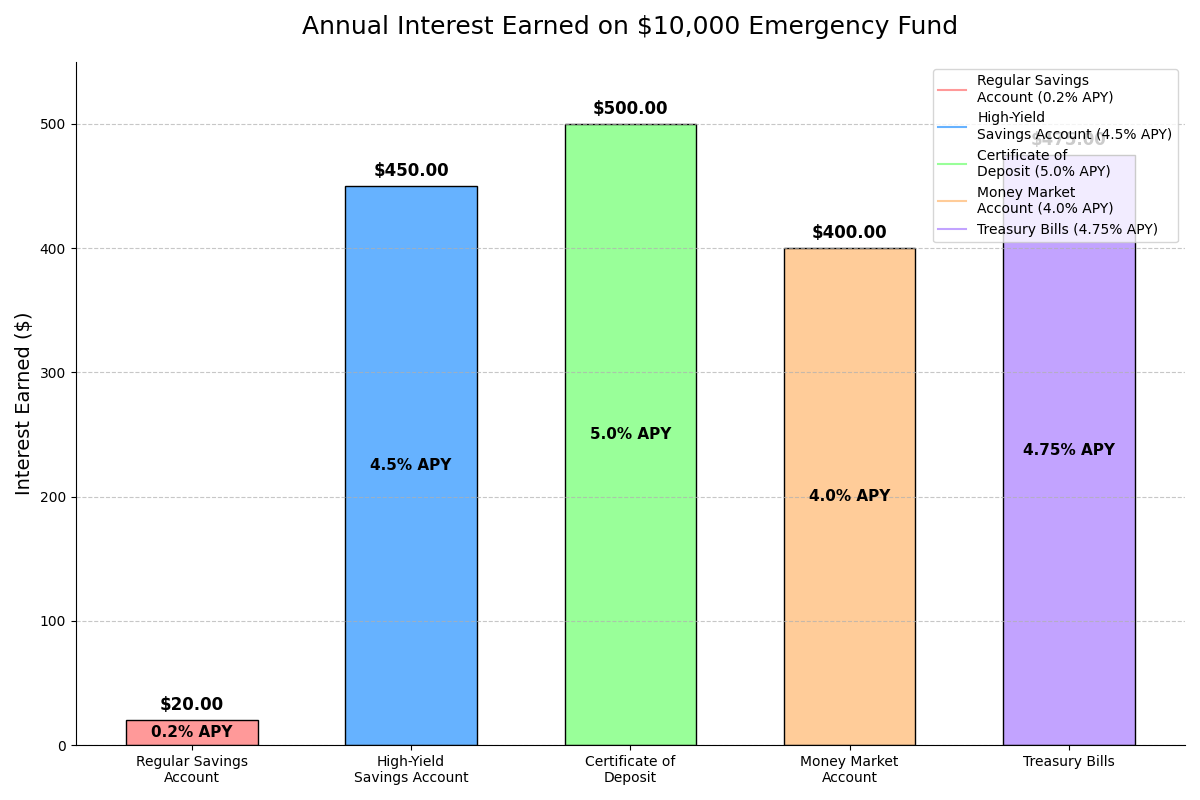

Best Options for Your Emergency Savings

- High-Yield Savings Accounts (HYSAs)

- APY in 2025: 4.50-4.66%

- Pros: FDIC-insured, highly liquid, competitive interest rates

- Cons: Rates may change over time

- Best for: Most emergency funds

- Top options in 2025: Axos Bank (4.66% APY), BrioDirect (4.50% APY), SoFi (4.35% APY) NerdWallet

- Money Market Accounts

- APY in 2025: Around 4.0%

- Pros: FDIC-insured, may offer check-writing abilities

- Cons: May have higher minimum balance requirements

- Best for: Larger emergency funds where occasional direct access is desired

- Certificates of Deposit (CDs)

- APY in 2025: Around 5.0% for short-term CDs

- Pros: Higher interest rates, FDIC-insured

- Cons: Early withdrawal penalties

- Best for: Part of larger emergency funds using a CD ladder strategy

- Treasury Bills

- APY in 2025: Around 4.75%

- Pros: Backed by the U.S. government, tax advantages

- Cons: Slightly less liquid than savings accounts

- Best for: Portion of larger emergency funds

- Regular Savings Accounts

- APY in 2025: 0.1-0.2%

- Pros: Maximum liquidity, FDIC-insured

- Cons: Very low interest rates

- Best for: Temporary holding or the portion needed for immediate access

Where NOT to Keep Your Emergency Fund

Avoid these locations for your emergency savings:

- Investment accounts (stocks, mutual funds): Too volatile for emergency money

- Physical cash at home: Risk of theft, fire, and no interest earned

- Crypto or alternative investments: Too volatile and potentially illiquid

- Retirement accounts: Early withdrawal penalties and tax consequences

- Account that’s difficult to access: Defeats the purpose of emergency funds

The best strategy for many people is to use a high-yield savings account for the bulk of their emergency fund, potentially with a portion in slightly higher-yielding but still safe options like short-term CDs or Treasury bills if their emergency fund is substantial.

How to Build Your Emergency Fund Fast in 2025

Building an emergency fund from scratch might seem daunting, but with a strategic approach, you can make significant progress even within a few months. Here’s a step-by-step plan to accelerate your emergency savings:

1. Set Clear, Achievable Goals with Deadlines

Break your emergency fund target into smaller milestones:

- First $1,000 by [specific date]

- Three months of expenses by [specific date]

- Full emergency fund by [specific date]

Research shows that specific goals with deadlines are much more likely to be achieved than vague intentions.

2. Create a Budget That Prioritizes Emergency Savings

- Track all expenses for 30 days to identify spending patterns

- Use the 50/30/20 rule: 50% for needs, 30% for wants, and at least 20% for savings (with emergency fund taking priority)

- Consider using budgeting apps like Mint, YNAB, or Personal Capital to automate tracking

3. Automate Your Savings

Set up automatic transfers to your emergency fund account on payday. This “pay yourself first” approach ensures savings happen before discretionary spending.

4. Find Ways to Increase Your Income Temporarily

Consider these options to accelerate your emergency fund growth:

- Ask for overtime at your current job

- Take on side gigs or freelance work

- Sell unused items around your home

- Rent out a spare room or parking space

- Driver for ride-sharing services during high-demand times

5. Reduce Expenses Temporarily

Look for temporary reductions that can free up cash for your emergency fund:

- Pause or downgrade subscription services

- Implement a shopping ban for non-essentials

- Cook at home instead of eating out

- Negotiate bills like insurance, phone service, and internet

- Consider a “no-spend” challenge for 30 days

6. Use Windfalls Strategically

Dedicate financial windfalls directly to your emergency fund:

- Tax refunds

- Work bonuses

- Cash gifts

- Rebates

- Inheritance

7. Track Your Progress Visually

Create a visual representation of your progress, such as:

- A savings thermometer you color in as you reach milestones

- A spreadsheet with projections and actuals

- A dedicated app that shows progress toward your goal

How Quickly Can You Build an Emergency Fund?

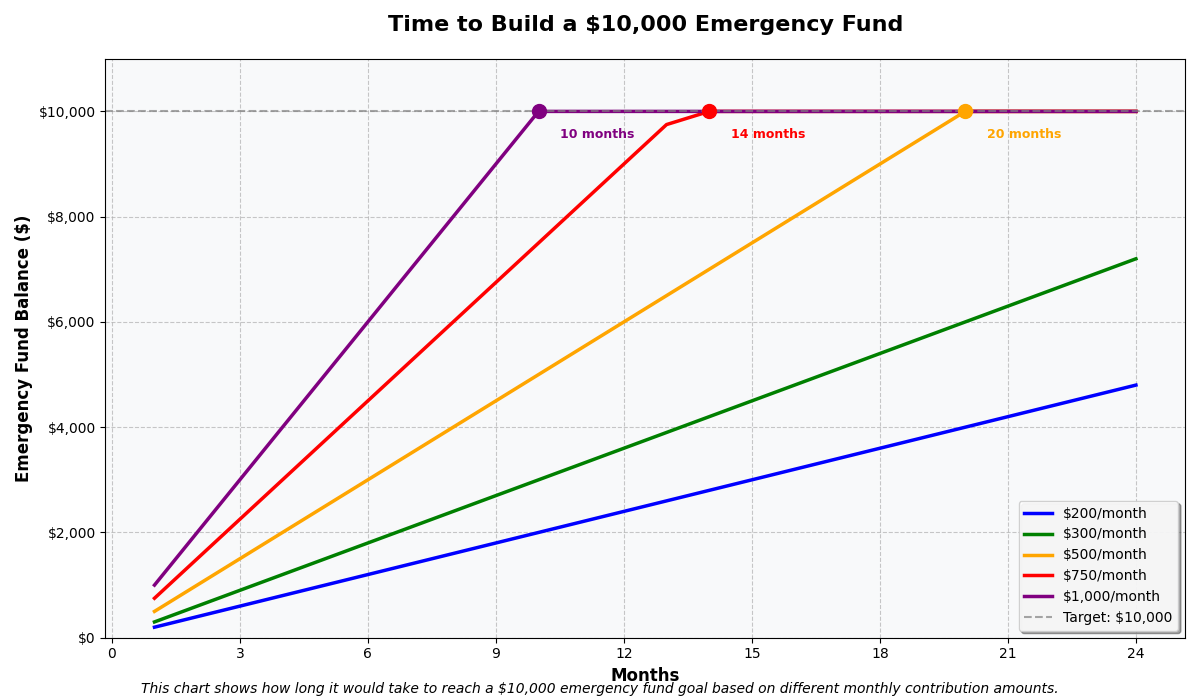

The chart below shows how consistently saving different monthly amounts can build a $10,000 emergency fund over time:

As you can see:

- Saving $200/month takes 50 months (over 4 years)

- Saving $500/month takes 20 months (less than 2 years)

- Saving $1,000/month takes just 10 months

By combining expense reduction with income increases, many people can temporarily save $500-$1,000 monthly and build their emergency fund much faster than they might have thought possible.

When to Use Your Emergency Fund (And When Not To)

Having clear guidelines about when to tap into your emergency fund helps ensure it’s available when truly needed.

Appropriate Uses for Emergency Funds

Your emergency fund should be used for:

- Unexpected medical or dental expenses not covered by insurance

- Essential home repairs (broken furnace, water heater, roof damage)

- Car repairs needed for transportation to work

- Job loss or significant income reduction

- Unavoidable travel for family emergencies

When NOT to Use Your Emergency Fund

Resist the temptation to use emergency savings for:

- Planned expenses (holidays, birthdays, annual insurance premiums)

- Vacations or other discretionary travel

- Electronics or other upgrades that aren’t essential

- Investment opportunities, even if they seem time-sensitive

- Regular bills that should be part of your normal budget

The Three-Question Test

Before tapping your emergency fund, ask yourself these three questions:

- Is it unexpected? (You didn’t see it coming)

- Is it necessary? (You can’t function without addressing it)

- Is it urgent? (It can’t wait until you save for it)

If the answer to all three questions is “yes,” then using your emergency fund is appropriate.

How to Replenish Your Emergency Fund

Eventually, you’ll likely need to use your emergency fund—that’s why you have it! When you do, make replenishing it your top financial priority.

Steps to Rebuild Your Emergency Fund

- Adjust your budget immediately to redirect money to your emergency fund

- Set a deadline for replenishing the full amount

- Consider a temporary lifestyle downgrade until the fund is restored

- Look for one-time ways to earn extra money specifically for rebuilding

- Put all windfalls toward replenishment until you’re back at your target

Remember that rebuilding your emergency fund takes precedence over most other financial goals (except perhaps minimum debt payments) since you’re now operating without your financial safety net.

Common Emergency Fund Mistakes to Avoid

Even with the best intentions, people often make these mistakes with their emergency funds:

1. Keeping Too Much in Cash

While having an emergency fund is crucial, keeping excessive amounts (over 12 months of expenses) in low-yield accounts can hamper your long-term financial growth. Once you’ve built an adequate emergency fund, direct additional savings toward retirement, investments, or other financial goals.

2. Having an Emergency Fund But Still Using Credit

Some people maintain an emergency fund but still reach for credit cards when unexpected expenses arise, wanting to “preserve” their savings. This defeats the purpose and costs you in interest charges.

3. Making the Fund Too Accessible

Your emergency fund should be separate from your checking account but not so difficult to access that you can’t get the money when truly needed. A dedicated high-yield savings account at a different bank from your checking account often strikes the right balance.

4. Not Adjusting Your Emergency Fund as Life Changes

Major life changes—like buying a home, having children, or switching from employed to self-employed status—should trigger a reassessment of your emergency fund target.

5. Using It for Planned Expenses

Predictable annual expenses like insurance premiums, property taxes, or holiday spending should have their own sinking funds, separate from your emergency fund.

Conclusion: Your Action Plan for Financial Security

Building an emergency fund is one of the most powerful steps you can take toward financial security and peace of mind. In today’s uncertain economy, having cash reserves isn’t just a good financial practice—it’s essential protection against life’s inevitable surprises.

Your 5-Step Emergency Fund Action Plan

- Calculate your target using our emergency fund calculator approach

- Open a dedicated high-yield savings account specifically for emergency savings

- Set up automatic transfers from your checking account on payday

- Find ways to temporarily boost savings through increased income or reduced expenses

- Track your progress and celebrate reaching milestones

Even if you can only save small amounts initially, the peace of mind that comes with having even a modest emergency fund is invaluable. Start where you are, be consistent, and watch your financial security grow month by month.

Additional Resources on Money Vanguard

For more financial guidance, check out these related articles: